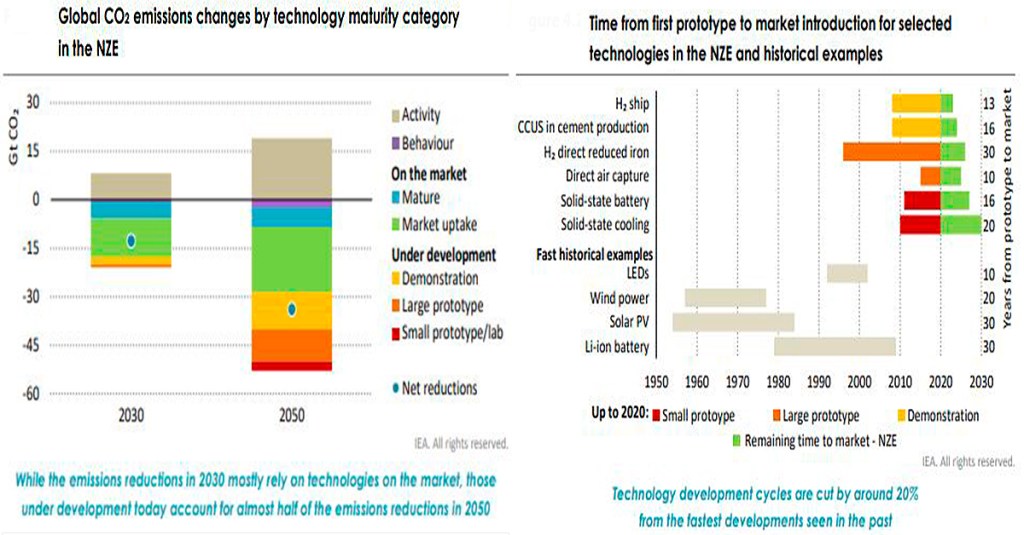

The EU aggregated GAR stands at 7.9%, which identifies the institutions’ assets financing activities that are environmentally sustainable according to the EU taxonomy.

More disclosure on transition strategies and GHG emissions would be needed to allow banks and supervisors to assess climate risk more accurately. It is important banks to expand their data infrastructure to include clients’ information at activity level.

Regarding the EU taxonomy classification, banks are currently in different development phases to assess the greenness of their exposures. The two estimation techniques, banks’ bottom-up estimates and a top-down tool, are considered in the exercise and the report highlights the differences in outcomes.

The scenario analysis shows that the impact of climate-related risks across banks has different magnitudes and is concentrated in some particular sectors. The findings should be considered as starting point estimates for future work on climate risk.

More on: https://bit.ly/3ufO53o

The study highlights the importance of promoting and coordinating the collaboration of the different financial actors to address the priority sustainability challenges (sustainable finace). It analyses the different mechanisms that are facilitating the integration of climate change policies and emphasizes the interest of considering the financial sector, in the coordination of policies, such as the implementation of new Laws on Climate Change and Energy Transition.

The study highlights the importance of promoting and coordinating the collaboration of the different financial actors to address the priority sustainability challenges (sustainable finace). It analyses the different mechanisms that are facilitating the integration of climate change policies and emphasizes the interest of considering the financial sector, in the coordination of policies, such as the implementation of new Laws on Climate Change and Energy Transition. ersal access to energy, focusing the analysis on Latin America. From here, the job carries out a critical study of the different renewable energy support mechanisms in the region. Afterwards, it studies the national R&D programs. The writing continues with the agents of the market and the roles and issues they find in their value chain within the region. From it, the book introduces the subject of investment, uncovering the ultimate problem, as well as the origin and destination of the investment flows that Latin America has received in renewable energy. Before finalizing, it analyses the financial instruments used for investment in renewable energy. Finally, the work ends with two real business cases of investment in power plants, which are financially modelled (Project Finance and Project Bonds). As a final conclusion, the writing highlights business opportunities, obstacles and solutions, all influencing the development of renewable energies in the region.

ersal access to energy, focusing the analysis on Latin America. From here, the job carries out a critical study of the different renewable energy support mechanisms in the region. Afterwards, it studies the national R&D programs. The writing continues with the agents of the market and the roles and issues they find in their value chain within the region. From it, the book introduces the subject of investment, uncovering the ultimate problem, as well as the origin and destination of the investment flows that Latin America has received in renewable energy. Before finalizing, it analyses the financial instruments used for investment in renewable energy. Finally, the work ends with two real business cases of investment in power plants, which are financially modelled (Project Finance and Project Bonds). As a final conclusion, the writing highlights business opportunities, obstacles and solutions, all influencing the development of renewable energies in the region.